Risk Management and Contract Models in Tunnel Construction – Part 1: Basics of Risk Management

Risk management should ensure that the project objectives are achieved. Adequate risk management also supports the decision-making process as to which contract model is suitable for the specifics of tunnel construction projects. For this purpose, it is important to know the basics and the procedure of risk management, which are presented in this article. In the following parts of the series, risk management, contract types, their selection and incentives from the perspective of risk management and insurance in tunnel construction will be presented and explained in more detail. The purpose of this series is to create a greater awareness of risks and to deal with them accordingly so that the project objectives can be achieved.

1 Introduction

Risk management is a project management task in which the opportunities and risks of a project are identified, analyzed, evaluated and monitored. Project-specific risk management is intended to ensure the achievement of project objectives and thus the success of major projects [1, p. 226; 2, p. 31].

Effective cost and risk management is crucial to the success of major projects. Significant cost and schedule overruns in major projects show that risk management is often not given the importance it should have. In order to be able to measure and control cost and schedule against the defined targets, it is necessary to assess risks transparently and take them into account appropriately. Another point is the meaningful presentation of the results as a decision-making aid for the client and its management.

2 Fundamentals of Risk Management

2.1 Components of Risk Management

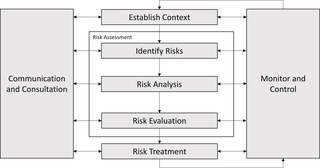

1 | Risk Management

1 | Risk Management

Credit/Quelle: [3, S. 10]

Risk management is a process that can be broken down into further subprocesses. The aspects of identification, analysis, evaluation and management are briefly outlined here (see Fig. 1). Of course, risk management also includes communication with the relevant stakeholders and monitoring during the execution of the project.

Risk identification serves to record all relevant risks that trigger further activities in subsequent risk management or are relevant for analysis. The risk analysis quantifies potential identified risks in terms of probability of occurrence and impact. The risk assessment serves as a classification to identify the relevant risks. Risk management comprises four methods (acceptance, avoidance, transfer or mitigation) to reduce or eliminate the risk.

2.2 Consideration of Uncertainties

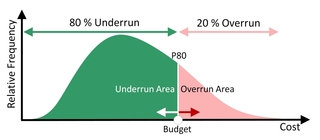

2 | Validation of a budget (here P80)

2 | Validation of a budget (here P80)

Credit/Quelle: [4, S. 20]

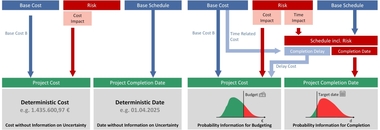

Figure 2 shows an example of the result of a probabilistic analysis. The budget is compared with the forecast range from risk management. It is shown that there is an 80% probability (P80) of staying below the upper budget limit.

Conversely, there is a 20% probability that the budget will be exceeded. The P value (or value at risk) indicates a value (e.g. € 1.0 million) within a probability distribution that will not be exceeded or undercut with an assigned probability (probability of exceeding or falling short). This allows the robustness of a selected budget to be determined and also validated cyclically.

By using the probabilistic method (evaluation using bandwidths), it is possible to map the actual level of knowledge about cost, schedule and risks for each project phase using the bandwidth. This allows reality to be modeled much better than with a single

deterministic value (point estimate). A deterministic approach suggests a certainty that is, however, subject to a high degree of uncertainty. With a bandwidth, the uncertainty can be shown transparently. The advantages of using probabilistic methods can be listed as follows [5]:

Consideration of uncertainties by specifying ranges instead of exact figures. Uncertainties can thus be taken into account transparently and used as a basis for decision-making.

The independent variables of risk assessment “probability of occurrence” and “impact“ are not mixed up (extent of damage), the information is not lost in the course of aggregating the cost and risks.

In the case of probabilistically determined cost, budgeting can be carried out with a degree of robustness. This indicates the probability of exceeding or falling short of the budget.

2.3 Cost Components

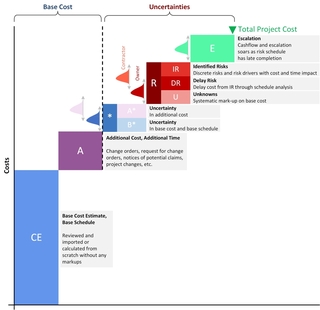

3 | Sample of a cost component structure

3 | Sample of a cost component structure

Credit/Quelle: [6, S. 7]

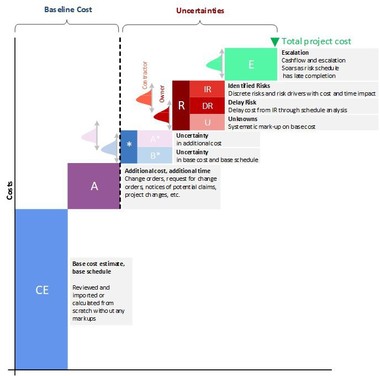

The use of cost components (see Fig. 3) aims to map cost transparently by specifying a clear cost structure. This structure should remain applicable from requirements planning through construction to the end of the project. The basic cost components are

Base cost (CE+A): cost if “everything goes according to plan“, without reserves for risks or approaches for escalation (price increase).

Risk cost (R): Cost arising from risks and opportunities that may occur but are not certain to materialize (probability of occurrence).

Escalation (E): Cost resulting from the forecast price increases (nominalization).

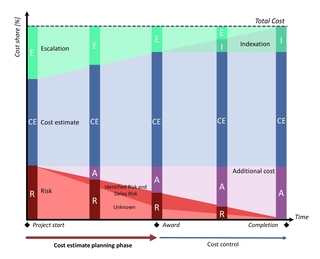

4 | Idealised representation of the cost components in the course of the project

4 | Idealised representation of the cost components in the course of the project

Credit/Quelle: [7, S. 11]

The cost component structure can be seen in the course of the project (see Fig. 4). During the planning phase, there is usually a high risk potential, but no additional cost as a result of risks that have occurred. In addition, the forecast cost for escalation depends on the implementation period (e.g. one year or ten years).

The risk potential is reduced in the course of construction, but additional cost is incurred in return. Escalation decreases with shorter intervals to the end of the project. After conclusion of the contract – if indexation clauses have been agreed – indexation cost arises (escalation incurred). Upon completion, there are no more uncertainties. The actual cost now only consists of the base cost (B= CE+A) and the indexation (I).

To validate the calculation of base cost, it is recommended that a contractor-based calculation be prepared. The calculation is carried out by experts according to common practice in the construction industry. One focus of the calculation is on the transparent determination of time-related cost [8, p. 123], as this contributes a primary part of the cost, especially in tunnel construction projects. With any type of delay, time-related cost has a high influence on the overall project cost.

Determining cost based on key figures is not expedient for complex large-scale projects, as this does not adequately reflect the time aspects. Key figures are often taken from the submission prices of other projects. These prices include allocations that are chosen speculatively by the contractor and are not transparent.

3 Results of Cost and Schedule

3.1 Cost

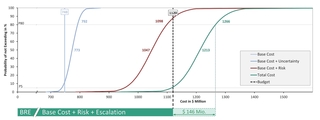

5 | Total cost broken down into cost components with uncertainties and budget comparison

5 | Total cost broken down into cost components with uncertainties and budget comparison

Credit/Quelle: Becker, Friedinger, Sander

The total project cost including its uncertainties are determined by simulation from the base cost, the risks and the escalation. The result of the analysis is presentedusing S-curves according to cost components (see Fig. 5). Starting from the deterministic base cost (748 million dollars in the example), the blue curve shows the base cost including quantities and price uncertainties. The risks (red curve) and the cost estimates for escalation (green curve) are added to this. The result is compared with the budget. In the example, the budget of 1120 million dollars corresponds to the P5 value, i.e. there is a 5% probability that the budget will be undershot and a 95% probability that it will be exceeded. In order to achieve a budget certainty of 80%, the budget would have to be increased by 146 million dollars.

3.2 Schedule

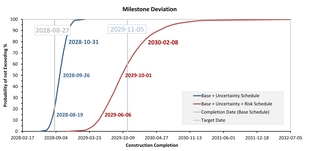

6 | Milestone deviation

6 | Milestone deviation

Credit/Quelle: Becker, Friedinger, Sander

The evaluation of the completion date (milestones) results in a systematically similar S-curve diagram as for the cost. The blue curve in the example in Figure 6 shows the basic schedule including uncertainties. The red curve is the result of adding identified risks (IR) with deadline impact. The comparison with the target date (in the example August 27, 2028) results in a schedule certainty of approx. 20% (P20). The target date can be met with a probability of 20% on the current reporting date. There is an 80% probability that it will be exceeded. In order to achieve a 60% certainty (P60) of the target date according to the current status, November 5, 2029 should be considered as the target date.

4 Outlook

In this article, the basics of risk management with regard to the classification of cost components, probabilistic methods and the presentation of results were shown. In the next part, the dependence of time and cost, which is particularly relevant in tunnel construction, will be discussed. It will describe how cost, schedule and risks are analyzed integrally.

This publication is supported by dtec.bw – Centre for Digitalisation and Technology Research of the University of the Bundeswehr [DigiPeC – Digital Perfomance Contracting Competence Center].