Creating Incentive Mechanisms for Integrated Project Delivery

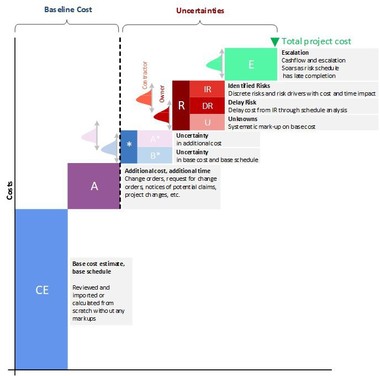

Due to their organisational structure and contracts, conventional project delivery models reach their limits in complex large-scale construction projects. In this context, Integrated Project Delivery (IPD) is an alternative regarding a joint project realisation. A probabilistic determination and integral consideration of cost, schedule and risk is the basis for developing an appropriate incentive mechanism for IPA. These elements are linked, simulated and analysed using a digital project risk twin. The results are transparently available to all project partners. Through the set incentive mechanism, the goals of the participants are harmonised and individual risk potentials and dependencies become visible. Based on this, an incentive mechanism has to be designed that ensures a fair pain/gain distribution between the participants.

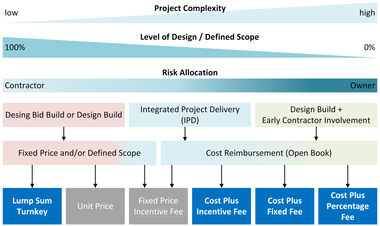

1 Project Delivery Models

1.1 Overview

A project delivery model consists of three components: the type of award, the contractor assignment form and the type of contract [1, pp. 64-65]. A distinction can be made between conventional project delivery models, which consist of an award and a contractor assignment form (e.g. sole contractor or general contractor), and a contract, which can be a unit price contract or a lump sum price contract. Integrated Project Delivery has a collaborative project structure, which leads to all participants acting in a “best-for-project” manner [2, p. 84]. This is...