Remuneration Models

The final part of the series of articles on risk management and contract models in tunnel construction focuses on the selection and description of remuneration models as a central component of project delivery models. In addition to a process for the development of a project-specific delivery model – the ‘Progressive Partnership Framework’ (PPF, developed at the IPD Innovation Hub1)) – four remuneration models are presented – lump sum, CPFF, CPPF and CPIF. The focus is on profit development from the contractor‘s perspective. Of particular note is the CPIF model, which can be selected on the basis of project-specific conditions and stands out for its potential for balanced, transparent and performance-oriented project delivery in complex infrastructure projects.

1 Introduction

The previous parts of this series covered the basics of risk management [1], the integrated consideration of cost, time and risks [2], risk management [3] and project insurance [4]. This part concludes the series and focuses on project delivery models and, in particular, their remuneration models. The standard project delivery models, with remuneration based on unit prices or a lump sum, often do not sufficiently take into account the particular characteristics of large-scale projects. This is because the planning status at the time of award does not adequately reflect the required work.

1 | Selection of the project delivery model based on [5]

1 | Selection of the project delivery model based on [5]

Credit/Quelle: Friedinger, Stangl, Sander

This is due both to the complexity of large-scale projects and to their risk profile. Large-scale projects are usually extremely complex, meaning that a complete description of the services in a traditional bill of quantities is only possible in theory. Similarly, it is only theoretically possible to adequately describe project risks in a bill of quantities. The unit price remuneration model would require an unachievable level of detail. The lump sum price model results in the greatest imbalance in risk distribution, as the contractor has to bear all the risks.

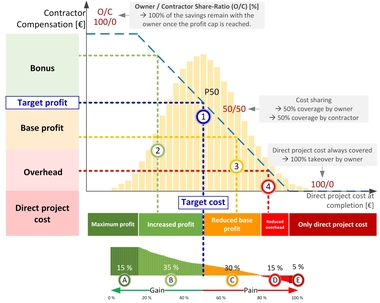

Figure 1 illustrates the relationship between complexity, known scope of services, risk distribution and the choice of the appropriate remuneration model. The higher the complexity of a project, the lower the planning maturity will generally be. In this case, the client has to bear more risk potential. For a simple project with a known scope of services, lump sum remuneration may well be appropriate. In this case, the risks are calculable for the contractor.

Chapter 3 of this article presents the remuneration models Lump Sum (LS), Cost Plus Fixed Fee (CPFF), Cost Plus Percentage Fee (CPPF) and Cost Plus Incentive Fee (CPIF) and compares the profit and loss potential for contractors [6].

The choice of a suitable remuneration model for a project is determined by the project-specific delivery model. For the development of such a project delivery model, a structured approach is recommended, systematically taking into account the individual characteristics of the project. The Progressive Partnership Framework, which is briefly presented below, offers such a methodological framework.

2 Progressive Partnership Framework

2 | PPF approach

2 | PPF approach

Credit/Quelle: Friedinger, Stangl, Sander

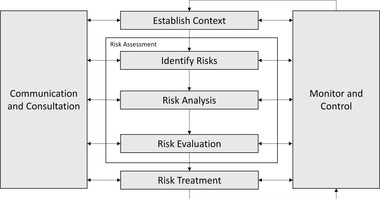

The Progressive Partnership Framework (PPF) represents a structured and practical approach to the development, initiation, and implementation of partnership-based project management models, such as integrated project delivery (IPD) or alliance models. It supports all project participants in the implementation of customised project delivery models that are tailored to the specific requirements and conditions of a project. The PPF was developed at the IPD Innovation Hub, operated by the Institute for Project Management and Construction Economics at the University of the Bundeswehr in Munich. The framework is based on experience gained from more than 20 national and international projects and offers methodological support in selecting suitable processes, defining remuneration models and ensuring transparent cost control.

Current examples of the successful application of the PPF include Amprion GmbH‘s Progressive Construction Partnering Contract for large-scale projects such as the Rhine-Main Link and Corridor B, the compact IPD pilot project of the Bavarian State Ministry of Housing, Construction and Transport, and the continuous further development of Deutsche Bahn‘s PM rail projects through the integration of PPF elements.

The application of PPF is structured in four stages (see Fig. 2):

I. Methodological foundation: The nine principles of PPF

1. Competencies and team alignment

2. Cost components

3. Probabilistic methods

4. Transparent calculation

5. Risk management

6. Integral analysis of cost, schedule and risk

7. Breakdown into construction phases

8. Individual remuneration models for

construction phases

9. Incentive mechanism and target cost

II. Selection of individual modules

A project delivery model is created from various modules that are selected in a structured process.

III. Creation of the project delivery model

Based on the principles and the selected modules, a project-specific delivery model is developed.

IV. Contract development or validation

The project delivery model then serves as the basis for creating a suitable contract or validating an existing contract.

This approach makes the PPF an effective tool for developing a customised delivery model for each project, enabling transparent, efficient and collaborative project implementation.

The selection of the remuneration model is a central module in the systematic development of a project delivery model. The choice is not limited to a single model: as the example of the Progressive Construction Partnering Contract shows, several remuneration models can be applied in parallel to construction phases of varying complexity within a project.

Four remuneration models that can be used within the framework of the PPF are explained below.

3 Remuneration Models

3 | Composition of the contractor‘s remuneration – based on [9]

3 | Composition of the contractor‘s remuneration – based on [9]

Credit/Quelle: Friedinger, Stangl, Sander

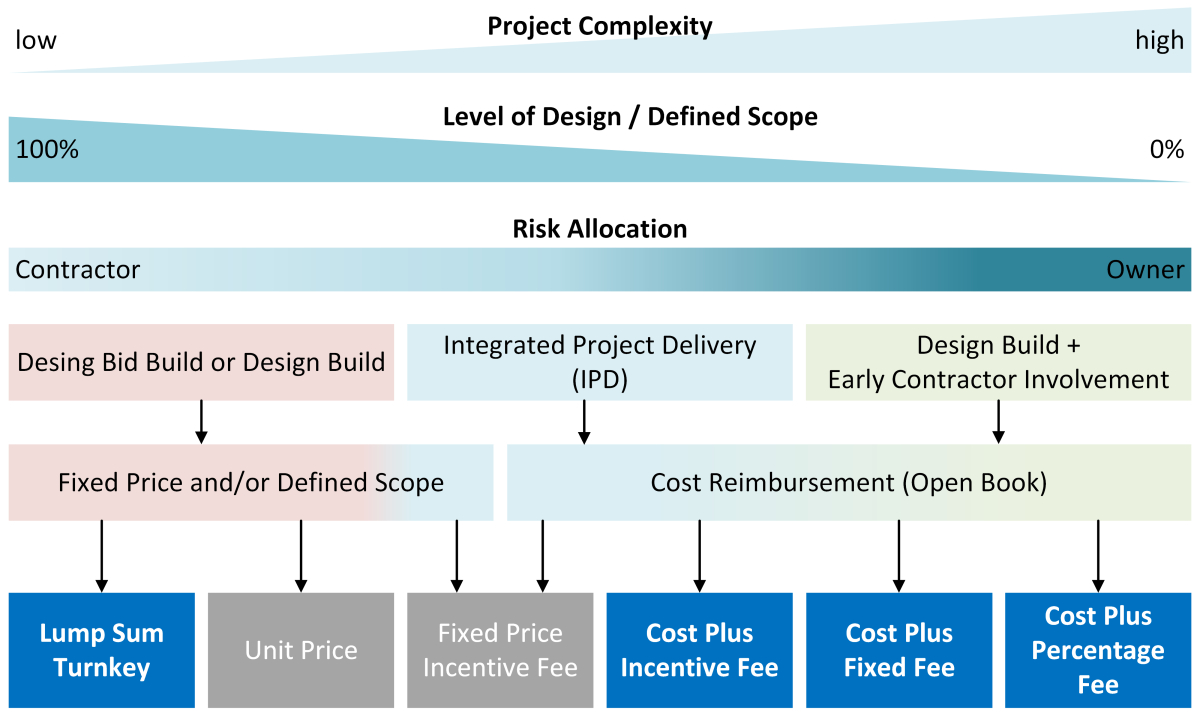

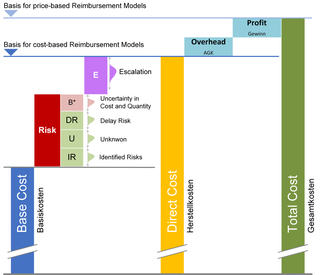

Remuneration models can basically be divided into two categories: cost-based and price-based models. The lump sum is a price-based model, as the contractually agreed service is remunerated at a fixed price. This price already includes incentives and the calculated profit.

In contrast, cost-based models such as CPFF (cost plus fixed fee), CPPF (cost plus percentage fee) or CPIF (cost plus incentive fee) always reimburse the actual production cost (direct cost) in full. Figure 3 shows the level at which the respective remuneration model is agreed.

The fundamental difference between the two categories lies in the transparency of the cost components: in cost-based models, these are disclosed, usually determined jointly and set out in a contract [10].

The manufacturing cost (direct cost) includes the risks and any escalation (price increase). If a risk or price increase occurs, this is reimbursed as part of an Open Book settlement. In addition, a surcharge for overhead cost and profit is agreed between the client and the contractor. Depending on the model, this surcharge can be structured as follows:

Fixed amount (CPFF)

Fixed percentage (CPPF) or

Performance-based via a bonus/penalty system (CPIF)

The following chapter compares the Lump Sum, Cost Plus Fixed Fee, Cost Plus Percentage Fee, and Cost Plus Incentive Fee remuneration models.

3.1 Lump Sum Pricing Model

The lump sum pricing model is a price-based remuneration model. A fixed amount, known as the price, is agreed for the provision of a clearly defined service or a clearly defined project. This price is binding if the agreed scope of services remains unchanged.

Since only a total price is specified, the detailed composition – i.e. direct cost including surcharges for risks, overhead cost and profit – remains undisclosed to the client. Despite its lack of transparency, this model offers the client a high degree of cost certainty, as all risks are borne by the contractor. In order to increase their profit, the contractor can optimise their direct cost.

This remuneration model is used when the scope of services is clearly definable and the risks for the contractor are therefore apparent and calculable [11].

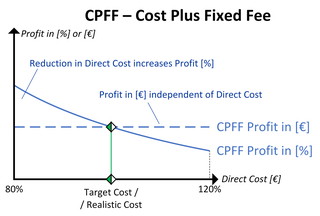

3.2 CPFF Model (Cost Plus Fixed Fee)

The CPFF model (Cost Plus Fixed Fee) is a cost-based remuneration model in which the contractor is paid a fixed profit amount (fixed fee) in addition to full reimbursement of the actual production cost (direct cost). This profit is independent of the actual amount of the direct cost and therefore remains constant in absolute terms [12]. Figure 4 illustrates the profit development from the contractor‘s perspective in the CPFF model. The direct cost is plotted on the horizontal axis, while the profit is shown on the vertical axis in both absolute values [€] and percentages [%].

4 | Profile of profit change in relation to direct costs in a CPFF

4 | Profile of profit change in relation to direct costs in a CPFF

Credit/Quelle: Friedinger, Stangl, Sander

The so-called target cost – the realistically estimated cost for completing the project – are shown in the middle of the diagram. If this target value is achieved, the percentage profit corresponds to the originally calculated ratio of profit to cost.

If savings are made, i.e. the actual direct cost is below the target cost, the percentage profit share increases because the absolute profit remains constant (blue solid line). This means that the contractor is working more profitably in relative terms. If, on the other hand, the actual production

cost (direct cost) rise above the target cost, the percentage

profit decreases accordingly, although the absolute profit remains unchanged (blue dotted line).

For the contractor, this means a secure profit outlook with limited risk. For the client, on the other hand, it results in a high degree of cost transparency and transparent risk management. The CPFF model serves as a reference and comparison model for the remuneration models presented below.

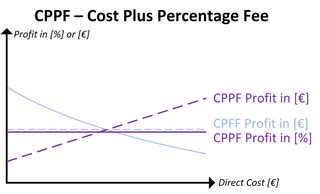

3.3 CPPF Model (Cost Plus Percentage Fee)

The CPPF model (cost plus percentage fee) is a cost-based remuneration model in which the contractor receives a percentage surcharge for profit in addition to full reimbursement of the actual manufacturing cost (direct cost). This surcharge is contractually fixed and applied to the respective manufacturing cost (direct cost). In contrast to other cost-plus variants, the maximum

profit here is not fixed absolutely, but varies proportionally to the actual cost [13]. Figure 5 shows the profit development of the CPPF model in comparison to the CPFF model. The axis labels are identical to Figure 4. While the profit in the CPFF remains constant as a fixed amount (blue dotted line), the purple dotted line in the CPPF shows a linear increase in profit in euros as the direct cost increases.

5 | Profile of profit change in relation to direct cost in a CPPF and CPFF

5 | Profile of profit change in relation to direct cost in a CPPF and CPFF

Credit/Quelle: Friedinger, Stangl, Sander

At the same time, the percentage profit in the CPPF – represented by the purple solid line – runs horizontally, as the surcharge remains the same regardless of the cost level.

This system essentially leads to a particular characteristic dynamic in which the contractor bears no risk: their profit is always calculated in proportion to the actual cost incurred – regardless of performance or efficiency. Lower cost results in a lower absolute profit, but the percentage surcharge stays the same. On the flip side, inefficient work can actually lead to higher profits, because rising cost automatically increases the profit in euros. This creates a significant cost risk for the client. At the same time, the model offers transparency, because both the actual cost according to Open Book accounting and the profit surcharge are clearly disclosed.

Despite these weaknesses, the CPPF model is used in practice when the scope of services cannot be clearly determined at the time of tendering and awarding the contract. This is the case for projects such as nuclear waste repositories, which are still being developed during the tendering process and therefore have a high potential for change. In these cases, the contractor cannot bear the risk. It must be assumed entirely by the client.

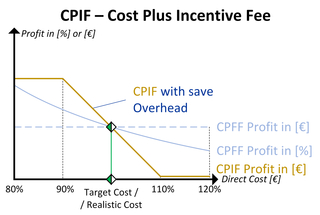

3.4 CPIF Model (Cost Plus Incentive Fee)

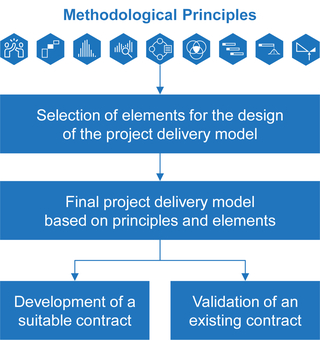

The CPIF model (Cost Plus Incentive Fee) is a cost-based remuneration model based on a performance-related remuneration system. The contractor receives full reimbursement of the actual manufacturing cost incurred (direct cost) and, in addition, a variable profit margin, the amount of which is linked to compliance with or deviation from a predefined target cost. At its core is a bonus/penalty system that creates financial incentives for cost efficiency [14]. Unlike the fixed profit margins of other Cost Plus models, the profit in CPIF is adjusted dynamically: if the contractor remains below the target cost, their profit increases in the form of a bonus.

6 | Profile of profit change in relation to direct cost in a CPIF and CPFF

6 | Profile of profit change in relation to direct cost in a CPIF and CPFF

Credit/Quelle: Friedinger, Stangl, Sander

If the target cost is exceeded, their profit is reduced accordingly – depending on the model, it can even drop to zero. This gives the contractor an economic incentive to stay within the agreed cost framework without having to assume the full risk of exceeding the total cost. A different split can be agreed for savings and additional cost. In Figure 6, the yellow line of the CPIF is based on a 50/50 split for all areas of the bonus/penalty system. This means that if the target cost is exceeded or not reached, the deviation is borne equally by both partners, the contractor and the client.

Figure 6 shows the profit development for the CPIF model compared to the CPFF model. The axes are identical to the previous figures. While the profit in the CPFF remains constant regardless of the direct cost (blue dotted line), the profit in the CPIF model rises or falls depending on whether the target cost is exceeded or not reached. The yellow line in the diagram represents the absolute profit in the CPIF model. It rises when the actual cost is below the target cost and falls as soon as it is exceeded. This curve is typically linear and regressive, with the slope and limits being individually specified in the contract. The CPIF model is usually limited by a defined corridor, for example between 90% and 110% of the target cost. The variable adjustment of the profit is made within this corridor. Below or above these limits, no further bonus or penalty effect applies – the client bears all costs beyond the limits. The profit is therefore limited to a minimum or maximum value.

Due to its structure, the CPIF model offers a balanced distribution of risk: The contractor benefits from bonus payments for efficient work, while the client is protected from incalculable cost. At the same time, the contractor remains motivated to carry out the project in a cost-conscious and goal-oriented manner. A prerequisite for the effectiveness of the model is a realistic target cost agreement and a clear contractual definition of the profit adjustment mechanisms. The CPIF model is particularly suitable for complex or higher-risk projects where the scope of services has not yet been conclusively determined, but where cost control and efficiency promotion are nevertheless desired. It combines the flexibility of cost-based models with the performance incentives of price-oriented remuneration systems, thus creating a balance between transparency, fairness and economic control.

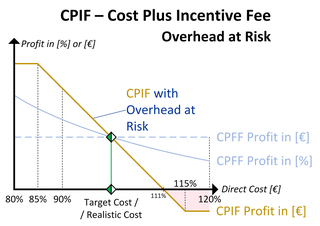

3.5 Outlook Incentives in CPIF

7 | Profile of profit change in relation to direct cost in a CPIF and CPFF, with overhead cost as part of the bonus/penalty system

7 | Profile of profit change in relation to direct cost in a CPIF and CPFF, with overhead cost as part of the bonus/penalty system

Credit/Quelle: Friedinger, Stangl, Sander

The incentive mechanism in CPIF can be designed as required. An example is shown in Figure 7: Here, the contractor puts its overhead cost at risk [14]. This means that additional cost exceeding a certain value (in the example, 111% of the target cost) are borne by the overhead cost.

On the other hand, there is the possibility of higher profits. The proportion of the AGK that is put at risk can be left to the contractor as an award criterion. As a result, the risk for the contractor is clearly calculable.

4 Summary

The selection or development of a suitable project delivery model tailored to the specific project requirements forms the basis for successful implementation. A key component of this is the remuneration model. Depending on the project situation, you can choose between price-based and cost-based approaches. While price-based models offer a high degree of cost certainty when the scope of services is known, they reach their limits in complex projects or in early planning phases. In these cases, cost-based models are more suitable. They are based on transparent remuneration, a clear definition of cost components and fair risk allocation. The Cost Plus Incentive Fee model is particularly noteworthy, as it integrates a transparent incentive mechanism, thereby promoting both a controllable approach and partnership, making it particularly suitable for integrated project delivery models.

The IPD Innovation Hub was initiated with the support of the dtec.bw project DigiPeC – Digital Performance Contracting Competence Center. Dtec.bw is the Bundeswehr‘s centre for digitalisation and technology research and is funded by the European Union as part of the NextGenerationEU investment project.